Change SASSA Banking Details For SRD R370 And Social Grants

Changing your banking details for SASSA grants is important to receive your payments without delays. Whether you’re Receiving SRD R370 grant or other social grants like the child grant, SASSA provides a process to update your banking information.

In this guide, I’ll walk you through the steps to change your banking details correctly, helping you avoid common issues that could affect your grant payments.

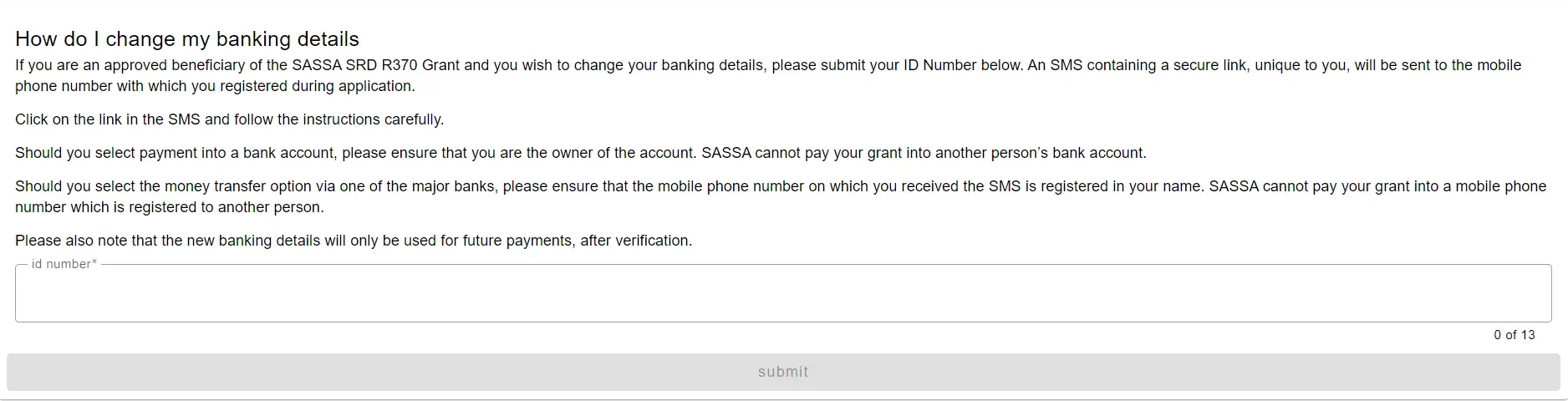

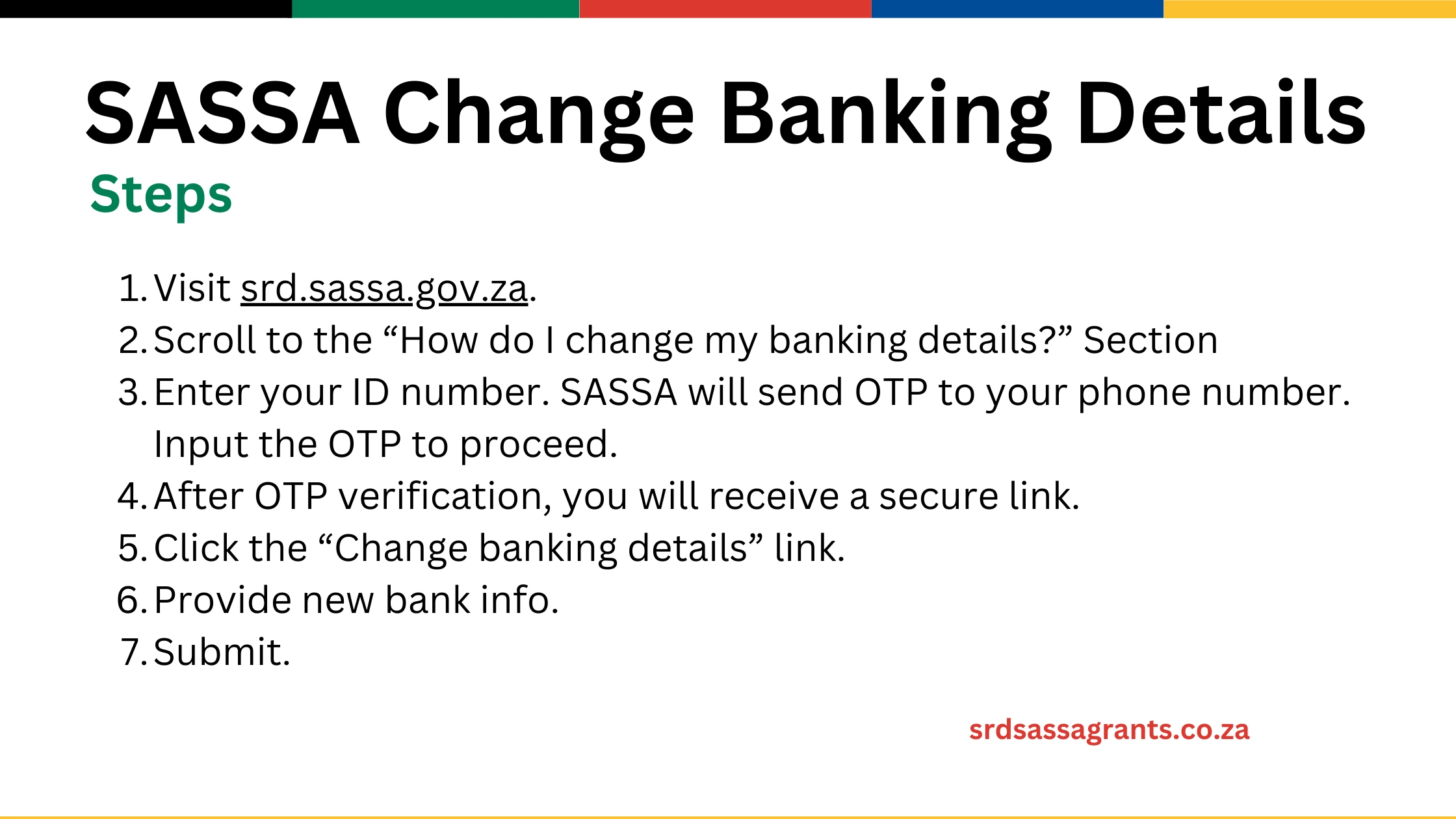

How To Change SASSA SRD Banking Details For R350?

- Visit srd.sassa.gov.za.

- Scroll to the “How do I change my banking details?” Section

- Enter your ID number. SASSA will send an SMS to your registered number with a secure link.

- Click the “Change banking details” link unique to you and read instructions.

- Select the bank account option to receive payments.

- Provide the required information:

- Bank Name: Select your bank from the list.

- Account Number: Input your account number accurately.

- Branch Code: Enter your bank’s branch code.

- Account Type: Specify if it’s a checking or savings account.

- Review and consent to the terms and conditions before submitting.

How To Change Banking Details For SASSA Social Grants? (Child Grant)

To update your bank details for SASSA social grants, (child grant, old age grant etc.) you can utilize the SASSA Services Portal.

- Visit the SASSA Services Portal.

- log in to your account with your credentials.

- If you’re new to the portal, register by providing your personal information to create an account.

- Once logged in, Click on “Manage My Personal Information” button.

- Look for the bank account information and update it by providing new details.

- Click Save button and a one time pin will be sent to your contact number for confirmation.

If you’d like to change your SASSA payments to TymeBank, including details on how to set it up and take advantage of TymeBank’s features, click here to switch sassa payments to TymeBank.

How to Switch SASSA SRD Payment Methods?

You can change SRD grant payment methods just like updating your bank account information online.

Change From SASSA Card To Bank Account

- Visit srd.sassa.gov.za. Scroll to “How do I change my banking details?”

- Enter your ID number to receive an OTP via SMS. Input the OTP to verify and get a secure link.

- Click the “Change banking details” link. Read instructions and select the payment into bank Account option.

- Input your bank details and submit after agreeing to the terms.

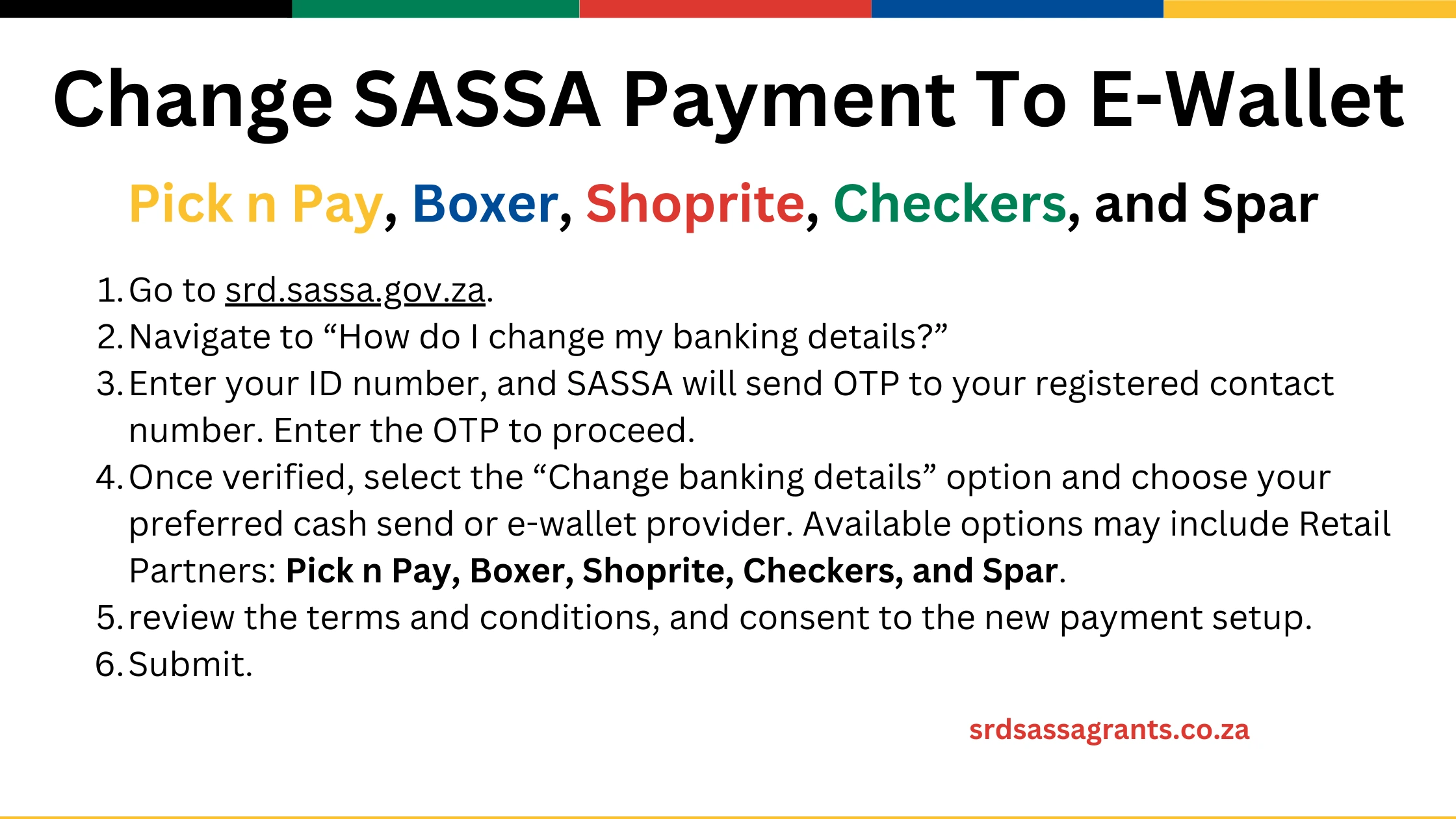

Switch From Bank Account To Cash Send or E-Wallet

- Visit srd.sassa.gov.za.

- Go to “How do I change my banking details?”

- Enter your ID number to receive a secure link unique to you.

- Click “Change banking details” link and choose a cash send or e-wallet provider.

- Retail partners: Pick n Pay, Boxer, Shoprite, Checkers, Spar.

- E-wallets: MoyaApp or other approved options.

- Follow the prompts, review terms, and consent.

- Submit your updated payment method.

What Is SASSA Change Banking Details Link?

The SASSA Change Banking Details Link is a secure, unique link sent to the registered mobile number when you request to update banking details for the SRD grant. This link provides instructions on updating banking details and allows users to securely submit their new payment information.

How To Check Or Confirm SASSA Updated Banking Details?

- You can check your SASSA status to confirm your SASSA SRD R370 Banking details have been updated.

- SASSA sends an SMS or email notification once your R350 banking details are updated.

- Login to SASSA services portal to check your current banking details for social grants (child grant).

Why Banking Details Updates Fail or Stay Pending?

The 3 most common reasons for SASSA change banking details are Pending because of:

- Verification delays – SASSA may take time to process and verify new banking details before approving changes.

- Incorrect information – Errors in the ID number, bank account details, or personal details can lead to processing delays.

- System issues – Technical glitches on the SASSA system or banking platform may cause the update request to remain pending.

The 3 usual reasons for SRD banking details failed are:

- Invalid account number – If the bank account number entered is incorrect or inactive, SASSA will reject the update.

- Name mismatch – The bank account must be registered in the grant recipient’s name; otherwise, the update will fail.

- Unsupported bank – Some bank accounts, such as certain savings accounts or e-wallets, may not be accepted by SASSA.

How Long SASSA Take to Change Bank Details?

SASSA requires a period of approximately 7 to 10 days to process any changes made to your banking information. They will confirm the account details using other government records to make sure payments are safe and correct.

Other Methods To SRD Change Banking Details

- By Visiting The SASSA Office

- At the office, you will be asked to fill out a form to change your bank details

- Using MoyaApp

- Login to the MoyaApp.

- On the SASSA profile, Click on “Change Banking Information.”

- Simply Submit your New Bank Particulars.

- Call SASSA

- You can also call SASSA’s toll-free number, 0800 60 10 11, to update banking information.

Why Do You Need To Update Your Bank Details?

- If you have terminated your previous bank account and established a new one.

- If you have transitioned from a savings account to a checking account or the other way around.

- if your bank has altered your account number as a result of a system enhancement.

- If you’ve realized that the bank details you previously provided to SASSA are incorrect, it’s crucial to update them to prevent payment delays or issues.

- If you have reason to believe that there has been fraudulent activity associated with your existing bank account.